Taking a major step toward improved public transparency regarding the city’s use of tax incentives to spur development, the Baltimore Finance Board approved a resolution this week that will require the city to post critical data about the costs and benefits of one particularly controversial tax break.

Sponsored by Comptroller Bill Henry, the resolution will require the city to produce an annual report aggregating a wide swath of financial information on what are known as TIFs, or tax increment financing deals.

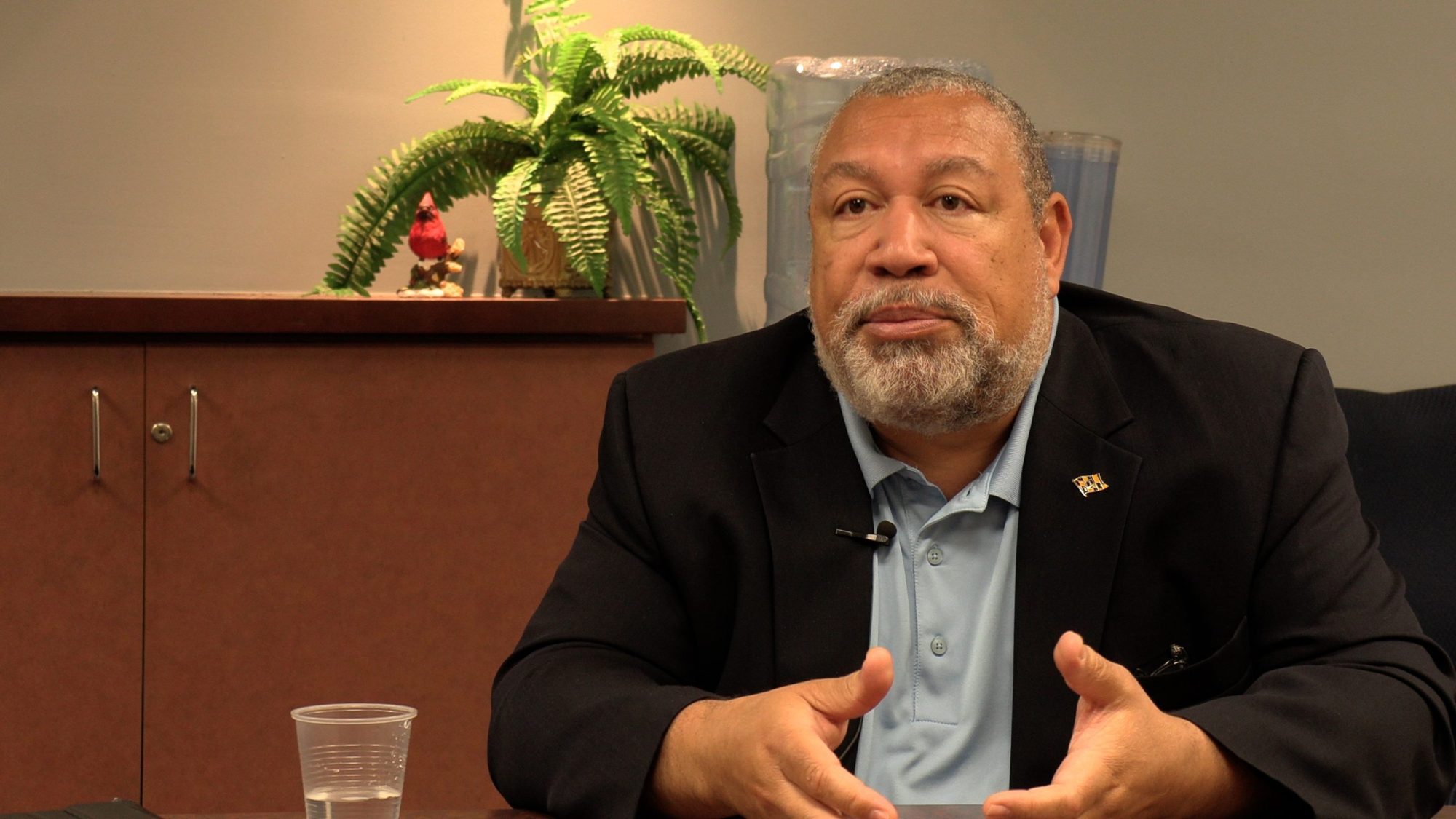

“The idea that all of this information about development incentives that the city is providing… should not just be public information, but it should be as accessible and available as possible.”

baltimore city comptroller bill henry

TIFs give decades’ worth of future property taxes to developers in advance, the total amount of which is calculated based on projections of how much revenue the new property will generate. The city raises the funds to pay for TIFs by issuing long-term bonds, which the developer pays back using property taxes generated by the new development.

This means that, in order to finance a TIF, the city forgoes any new revenue from the property for decades. However, as we have reported on extensively, for all the money the city diverts to developers (and away from the general fund) in the form of tax break instruments like TIFs, the criteria for calculating the size of these tax breaks—and the system for retroactively evaluating whether or not Baltimore and its residents actually benefit from them—are opaque at best (and non-existent at worst).

The reporting requirements outlined in Henry’s resolution include the total amount a developer has received from TIF proceeds to build a project, cumulative interest payments for each development, and the total aggregate sum the city has borrowed to finance TIF projects to date.

But it also drills down into some details of TIF spending that have otherwise been difficult to obtain.

For example, the resolution requires reporting on administrative expenses—such as legal fees and analysis costs—which result from issuing the bonds that finance TIFs. It also includes a side-by-side comparison of how actual spending by developers on the project compares to the original estimates presented when the TIF was approved.

In total, the resolution will require the city’s Board of Finance to post roughly ten sets of data on TIFs on its website every year.

After a finance board meeting this week, Henry said the resolution will provide residents of Baltimore a centralized database to monitor the status of TIFs. He also hopes it will answer one of the fundamental questions surrounding the city’s extensive use of tax breaks: are they delivering on the benefits promised when the city approved them?

“What I hope it does is what we have been moving towards,” Henry said. “The idea that all of this information about development incentives that the city is providing in an effort to build out tax base… all that information should not just be public information, but it should be as accessible and available as possible.”

Originally, TIFs were designed to stimulate development in areas that were considered blighted. However, Baltimore has used TIFs to spur growth in already prosperous neighborhoods like Harbor Point, a waterfront property bordered by the already affluent neighborhoods of Fells Point and Harbor East.

In Tax Broke, TRNN’s ongoing series of investigations into Baltimore’s reliance on tax breaks to fuel development, we examine the lack of transparency surrounding TIFs and other tax incentives.

The centerpiece of the series is a documentary outlining the history of the city’s struggle to grow, and the process by which incentives created to attract residents and new development have led to burgeoning costs to taxpayers, and little transparency on the final price tag or the performance of the projects financed with tax breaks.

Henry also said he is hoping that more work will be done to publicly vet substantive changes to construction plans that occur during development. He pointed to the yet-to-be-built greenspace promised during the approval of one of the city’s largest TIFs, the $105 million incentive for the development of Harbor Point in 2012.

The film also documents how a similar bill aimed at analyzing the benefits of TIFs was introduced by Councilwoman Odette Ramos last year. However, the bill failed to pass out of committee.

Henry said his proposal was a first step towards shedding more light on the process of using TIFs as a development tool. He also hopes it will prompt the city to delve deeper into the details of how TIF money is actually spent, which he believes has thus far been lacking: “The way the system is currently set up, the Board of Finance is the only body that continues to monitor TIFs after they’re approved.”

Henry also said he is hoping that more work will be done to publicly vet substantive changes to construction plans that occur during development. He pointed to the yet-to-be-built greenspace promised during the approval of one of the city’s largest TIFs, the $105 million incentive for the development of Harbor Point in 2012.

“Things like public amenities got pushed to the end of the project, like Point Park,” Henry said, referring to a still-to-be-built park encompassing the outer edge of the Harbor Point site.

“The total amount being spent on greenspace is significantly less than initially approved,” he added.

Henry qualified that the decreased amount spent on greenspace was due to spending on a bridge that connects Harbor Point to Central Avenue. Still, he asserted that these types of changes—changes that significantly alter the public component stipulated in the city’s approval of a TIF—will receive more public scrutiny in the future. “That was never a conversation that had to happen under the current process.”

Harbor Point is a private, mixed-use development encompassing 27 acres of prime waterfront real estate. The property is also the site of the Maryland headquarters of energy giant Exelon.

Currently, the city has more than a dozen active TIFs that were awarded for projects that are already built or are in development. According to the city’s most recent Comprehensive Annual Financial Report, or CAFR, the city has committed roughly $580 million in future property taxes to TIF projects. That includes roughly $242 million in interest.